Sponsored: FWA’s appeal is greatest in countries with extensive cable and xDSL networks

Most countries recognize that economic success and social development depend on fast and secure access to the Internet. Today, broadband access technologies are dominated by fiber, cable and DSL. But there is a new kid in town – 5G Fixed Wireless Access (FWA).

Last year in the US, FWA claimed 90% of all net broadband additions, mostly at the expense of cable and DSL. Mobile Network Operators (MNOs) achieved this with comparable throughput and, according to their subscribers, superior reliability

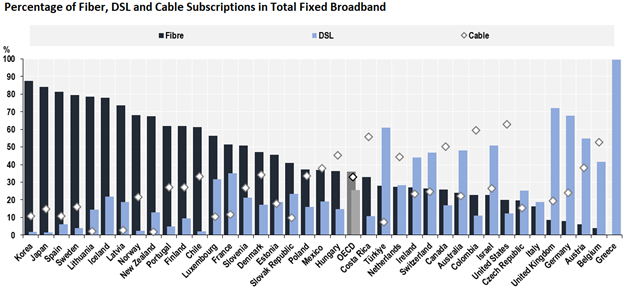

European MNOs are also deploying sub-6 GHz (midband) FWA to compete in markets dominated by cable and DSL. But as Figure 1 shows, most broadband subscriptions in Europe are served by fiber, which delivers gigabits instead of megabits. Can FWA deliver gigabits too?

MNOs in the US are delivering gigabits now using millimeter wave[1]. They are quietly deploying mmWave FWA to a) preserve midband spectrum capacity for mobile service, and b) establish a broadband beachhead on wired terrain. Full rollout of mmWave FWA will allow MNOs to continue to dominate cable and DSL megabits with mmWave gigabits and outshine fiber competitors with lower total cost of ownership (TCO) and faster time-to-revenue.

So will European MNOs deploy mmWave to serve fixed broadband, particularly in DSL/cable-heavy countries like the UK, Germany, Austria, Belgium, and Greece? They should, because mmWave FWA is more cost-effective than fiber and provides the throughput needed for future increases in broadband demand. Claims to the contrary are based on misconceptions about mmWave FWA. The following sets the record straight.

Invalid TCO analyses

Most TCO analyses comparing mmWave FWA to fiber do not consider the use of cost-effective precision network repeaters, which, by minimizing the deployment of fiber-connected network repeaters, which, by minimizing fiber-connected small cell base stations, minimize FWA network TCO and time-to-revenue. To date, this omission has occurred in several reports, including those from GSMA.

Likewise, most analyses do not consider the use of customer-installable, window-mounted mmWave-to-WiFi customer premise equipment (CPE) or mmWave subscriber repeaters, which facilitate indoor mmWave signal penetration. Instead, they include only professionally installed CPE, typically mounted on the roof.

Network repeaters mount to light or utility poles. Their purpose is re-direct mmWave signals beyond a small cell’s line-of-sight (LOS). Network repeaters typically contain two units, one facing the small cell and one facing the service area, which for FWA could be windows on the side of a Multi-Dwelling Unit (MDU) building, for example. Network repeaters can have a third unit to extend the mmWave signal to another repeater even further away from the small cell.

Without an understanding of network repeaters, MNOs would rightly conclude that mmWave’s LOS requirement would necessitate a massive new network, since sub-6 GHz cellular networks were not designed for LOS.

Create an overlay network, not a new one

Using repeaters, however, mmWave FWA acts as revenue-generating overlay to an MNO’s existing cellular network. In this scenario, traditional build-it-and-they-will come thinking does not apply. Capital expense and revenue move in tandem. Forget about spending on underutilized infrastructure expense for the sake of guaranteeing ubiquitous coverage. Think of delivering mmWave signals via highly directive spatial corridors to individual buildings – individual windows, in fact — instead of broad geographies.

New tools and techniques required

mmWave coverage can grow organically or MNOs can systematically cultivate it over a specified area. Either way, new radio frequency planning techniques are required. Traditional tools are optimized for sub-6 GHz mobility, where geographic information system (GIS) mapping resolves to ten meters or more and vertical information beyond the height of a mobile user is ignored. mmWave FWA requires much higher resolution GIS data, typically ten centimeters or less. This way, network planning can account for minor impacts to LOS-based coverage, like the corner of a building, or assure service to a single apartment window.

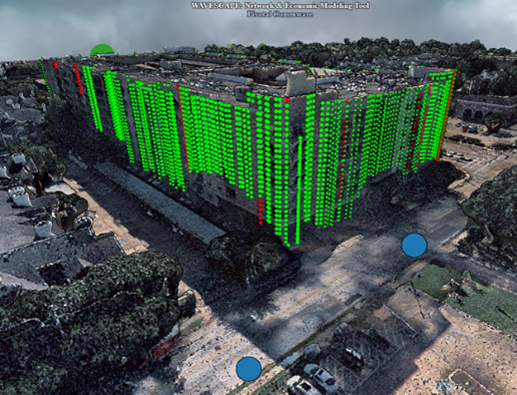

Worthy mmWave network planning tools do not exist. Pivotal Commware built its own, and along the way identified four more requirements:

- 3D mapping of building facades (Figure 3), using Light Detection and Ranging (LIDAR)

- Algorithms to optimize the placement network elements, including repeaters and small cells

- Machine learning to identify municipal furniture like light and utility poles, i.e., “structural feature extraction”

- Economic analysis so the MNO can examine trade-offs between coverage, cost, performance, and other factors.

Network repeater, subscriber repeater, cloud-based network and economic modelling software, cloud-based element manager. Sounds like the perfect mmWave product ecosystem, right? Not quite. That is because most MNOs have had little exposure to mmWave concepts like beam forming, LOS network planning, and economic analysis, let alone mmWave network design and installation.

Consequently, Pivotal developed a turnkey service that, along with its right-of-way and installation partners, provides sales-ready mmWave coverage and ongoing performance monitoring to MDU buildings specified by the MNO.

Too early but not too late

Figure 1 suggests that fiber deployment in Europe has been underway for years, before commercial mmWave was well understood. The EU’s 2014 Broadband Cost Reduction Directive, which turbo-charged fiber deployment, did not anticipate advances in mmWave technology like Holographic Beam Forming®, which has led to major cost, size, weight, and power consumption reductions.

This technology has turned network repeaters into 4 kg, 30W IoT-like devices instead of 150 kg, 1kW small cells. The EU could also be forgiven for dismissing repeaters as interference creators, which remains true at sub-6 GHz. mmWave repeaters use narrow beamforming as required. This obviates interference and preserves spectral hygiene, both of which remain problematic at lower frequencies.

Using repeaters, MNOs in the US have demonstrated that a mmWave FWA overlay on existing cellular networks offers a cost-effective alternative to a separate fiber network. European operators should take another look at mmWave FWA.

[1] Millimeter waves refer to frequencies starting at 24GHz and above. mmWave bands require line-of-sight or near-line-of-sight propagation but offer extremely high bandwidth and high speeds compared to sub-6 GHz bands.

About Pivotal Commware, Inc.

Pivotal Commware created the world’s first product ecosystem dedicated to solving millimeter wave’s most vexing challenges: WaveScape® network planning tool for optimizing the placement of network elements, Pivot 5G network repeaters for navigating signals around obstacles, Echo 5G subscriber repeaters for penetrating signals indoors through window glass, and Intelligent Beam Management System platform for managing and optimizing the repeater network.

Pivotal repeaters use its patented antenna technology, Holographic Beam Forming® for lowest cost, size, weight, and power consumption (C-SWaP). Pivotal Turnkey Services is an end-to-end solution for planning and deploying fixed wireless access (FWA) for Mobile Network Operators. The company is privately held and headquartered in Kirkland, Washington. For more information, visit www.pivotalcommware.com