Homes passed in the EU39* countries was almost 182.6 million (more than 50% of homes) in September 2020, compared to 172 million in September 2019.

The Market Panorama report was pulled together by IDATE and shows that the main movers in terms of homes passed in absolute numbers are: France added 4.6 million; Italy 2.8 million; Germany 2.7 million; and the UK 1.7 million.

The top five in terms of annual growth rates in homes passed is headed by Belgium up 155%, Serbia up 110%, Germany 66%, the UK 65% and Ireland 49%.

Accurate picture?

Caution is needed regarding the state of some countries’ digital infrastructure. Firstly, fibre is not the only game in town and secondly, the number of premises passed is not the same as the number that are in use by paying subscribers. For example, a new study by VATM found that the number of gigabit connections provided by cable networks in Germany is expected to reach 23.3 million by the end of June 2021, 8.4 million of which have subscribers. Of Deutsche Telekom’s 2.3 million fibre gigabit connections, 675,000 are in use.

In the UK where cable company Virgin Media, owned by Liberty Global and in the throes of merging with Telefonica UK (O2), plans to bring gigabit speeds to more than 15 million homes across its UK network by the end of 2021, and UPC Poland (also part of Liberty Global) so far connected more than 60 cities to its gigabit service.

Key milestone

This year[2], a key milestone has been reached, as FTTH/B Coverage in EU39 now amounts to more than half of total homes. By September 2020, EU39 reached a 52.5% coverage of FTTH/B networks while EU27+UK [3] sits at 43.8%, compared to respectively 49.9% and 39.4% in 2019. This shows a clear upward trend from the September 2015 figures when the coverage was at 39.8% in EU39 and 27.2% in EU27+UK.

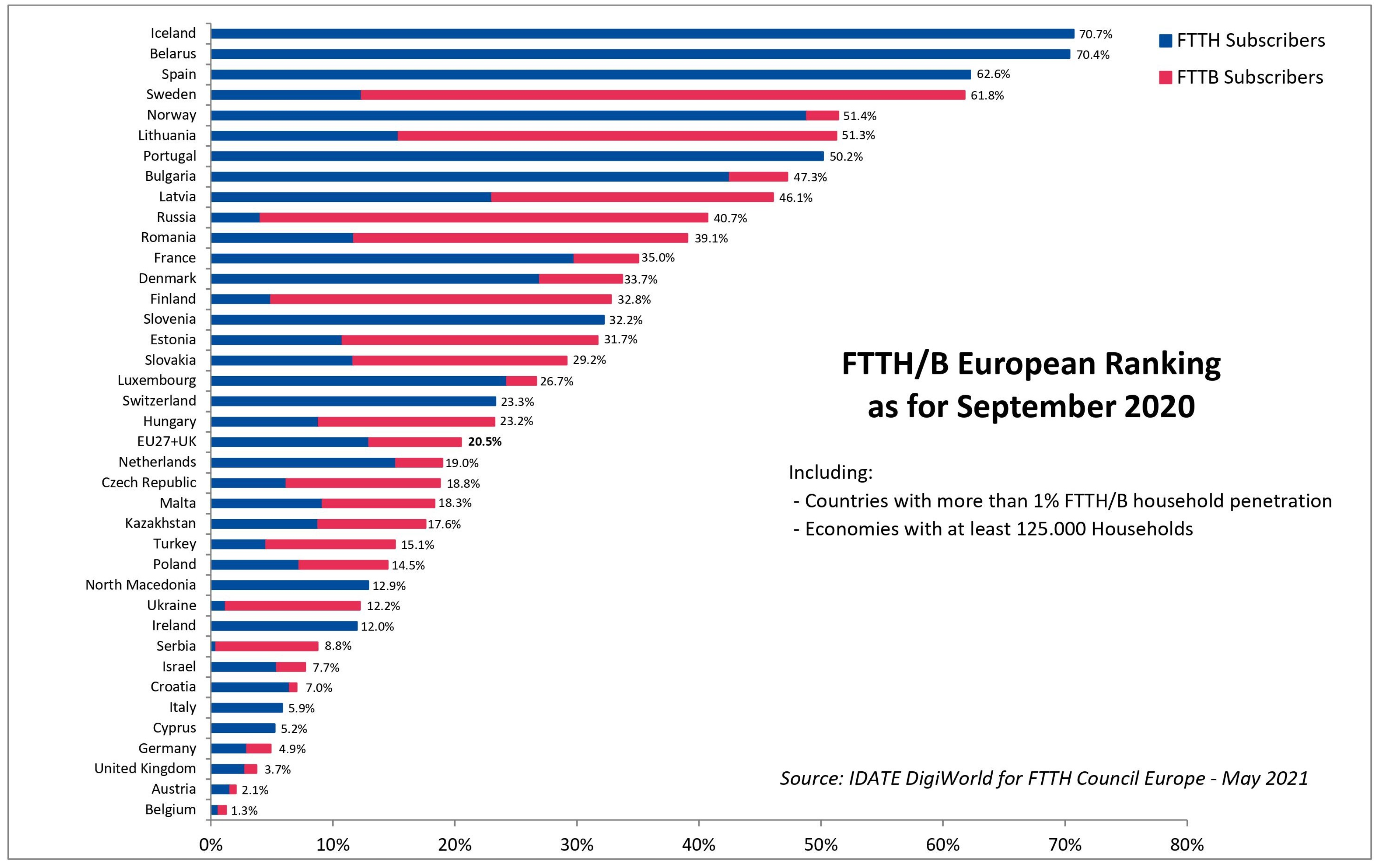

The number of FTTH and FTTB subscribers in Europe increased by 16.6% in EU39 in the year since September 2019 with 81.9 million FTTH/B subscribers in September 2020. Russia still plays a major role in this increase, however, it is interesting to note that the EU27+UK experienced a 20.4% increase on its own.

This year, the country adding the most subscribers is located in Western Europe. France added 2.787.000 new FTTH/B subscriptions, whereas Russia came second adding 1.681.000 new FTTH/B subscribers. Spain rounds out the top 3 with 1.436.000 new FTTH/B subscribers. Other countries also experienced an outstanding increase in their number of subscribers such as Turkey (+ 718.000) and Germany (+ 694.000).

By September 2020, the EU39 FTTH/B take-up4 rate raised to 44.9% in comparison to the 43% [5] rate registered by September 2019. For the third consecutive year, the take-up rate for EU27+UK surpasses the EU39’s one by reaching 46.9% (as opposed to 43.3% in September 2019).

Evolving tech

Fibre technologies have been continuously evolving during the last few years with a predominance of FTTH architecture over FTTB (63% vs 37%). Alternative internet service providers still make up the largest part of FTTH/B players, with a contribution of around 57% of the total fibre expansion.

It is interesting to note that many countries where legacy infrastructure still dominates have modified their strategy deploying more FTTH solutions, migrating from existing copper-based and cable-based networks towards fibre and are even intensifying copper switch-off. Nevertheless, three historically copper-strong countries (UK, Germany and Italy) are accounting for almost 60% of homes left to be passed with fibre in the EU27+UK region.

The ongoing COVID-19 pandemic, in turn, has demonstrated the necessity of both FTTH deployments and adoption. The governments and local authorities are increasingly involved in the digital transformation, introducing revised national programmes, subsidies and relevant policy framework to promote fibre expansion.

[*] The EU 39 includes Andorra, Austria, Belarus, Belgium, Bulgaria, Croatia, Czechia, Denmark, Estonia, Finland, France, Germany, Greece, Hungary, Iceland, Ireland, Israel, Italy, Kazakhstan, Latvia, Lithuania, Luxembourg, Malta, Macedonia, Netherlands, Norway, Poland, Portugal, Romania, Russia, Serbia, Slovakia, Slovenia, Spain, Sweden, Switzerland, Turkey, Ukraine and the UK

[2] Between September 2019 and September 2020

[3] The EU 27 + UK includes Austria, Belgium, Bulgaria, Croatia, Cyprus, Czechia, Denmark, Estonia, Finland, France, Germany, Greece, Hungary, Ireland, Italy, Latvia, Lithuania, Luxembourg, Malta, Netherlands, Poland, Portugal, Romania, Slovakia, Slovenia, Spain, Sweden, United Kingdom

[4] Take-up=Subscriptions/Homes Passed

[5] Figures recalculated using a bottom-up approach.

[6] Penetration rate = FTTH/B Subscriptions/households