After the successful launch of its bank in France, Spain is the telco’s second market to launch Orange Bank.

Two years after its launch in France, Orange Bank has 500,000 customers, according to Paul de Leusse, CEO, Orange Bank, who says the move into Spain supports Orange Group’s multiservice strategy and diversification into mobile and financial services across its markets.

Top savings rate

Orange Bank is a 100% mobile-based banking offer for Spanish consumers who will be able to open a current account with a Spanish IBAN, without a registration fee.

Customers who open a new savings account will receive 1% interest on savings deposits of up to €20,000, the highest available rate in Spain, according to Orange.

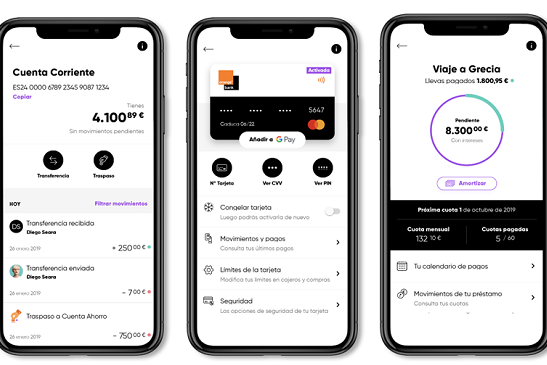

Orange customers will be able to access all of their banking services, at any time of the day, via their mobile and an app.

From this app, customers can perform day-to-day banking tasks, like checking their balance, paying with Apple Pay, moving money between their savings and current/cheque accounts, making free SEPA transfers, and managing their card.

For example, they can freeze a card temporarily in case of loss and reactivate it if found. Chat is available for customers needing help.

Biomteric security

In compliance with all banking regulation requirements, customers can also access these banking services securely using the biometric feature on their mobile phone, and avoiding passwords.

A key feature, according to the operator main innovations is the group management functionality, which allows the sharing or transfer of monies and expenses between several people.

Customers will be able to pay or manage accounts shared with multiple people, such as a water bill or a Netflix subscription.

As Narciso Perales, General Director of Orange Bank in Spain explains, “Banking is accelerating towards an online model, concentrated around access via mobiles, and Orange wants to play a leading role by providing a competitive, simple and accessible offer at any time and place.

“One of our differentiating values lies precisely in being a bank that does not come from the traditional banking space. Our hallmark as a leading telco enables us to be the most suited to design a mobile banking service for today’s highly mobile population.”