As MWC Shanghai 2023 wraps up Chinese operators aim to be central to 6G standards despite tensions

Speaking at the MWC Shanghai trade show that ended on Friday evening, China’s big telecom operators and vendors continued to spell out their plans to take and maintain the initiative in setting 6G cellular standards.

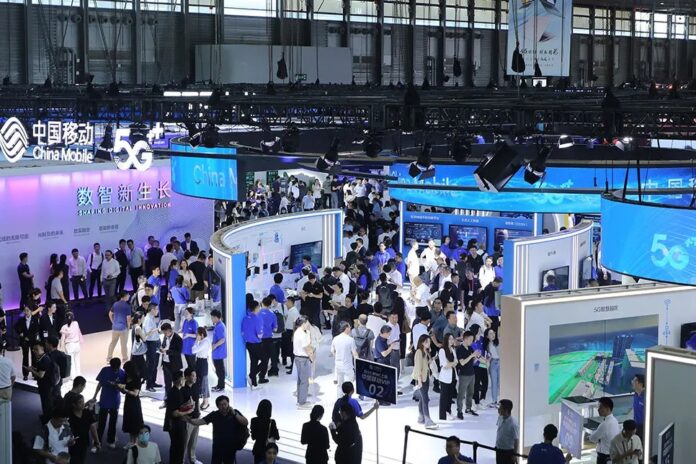

The show, which returned as an in-person event after a multi-year hiatus, saw around 300 companies showcasing the latest 5G innovations, although this year it was heavily dominated by Chinese firms as many big foreign firms like Samsung stayed away.

According to Nikkei Asia [subscription] China Mobile will push ahead with 6G research and development from multiple angles, chairman Yang Jie said at the event.

China Mobile deputy general manager Gao Tongqing said that now is a key time to identify crucial 6G technologies and the company will work hard to strengthen tech convergence and innovation. The company kicked off its 6G public experimental verification platform at the Shanghai event, which will provide an open and scenario-based joint R&D testing environment for industrial partners, test new business and application scenarios and lower the 6G R&D threshold.

The operator previewed two new 5G consumer services. Cloud phones would see phones tailored to different user segments with the apps, OS and voice and data processing all residing in the cloud. The other service is 5G new calling, which goes beyond 1G POTS voice, by integrating other apps into a phone call like real-time translation, multi-party video or remote guidance.

Meanwhile, China Unicom deputy general manager, Liang Baojun said the telco was determined to accelerate 6G R&D through collaboration with industry, academics and research institutes.

China remains a global leader in the reach of its 5G network. The country had 634m 5G users and over 2.73m base stations at the end of April, each accounting for roughly 60% of the global total, according to its Ministry of Industry and Information Technology. Spending on 5G networks was nearly 600bn yuan (US$83bn) through the end of April, according to the ministry.

Huawei for 5.5G

Huawei deputy chairwoman and CFO Meng Wanzhou delivered a keynote, discussing among other things, the vendor’s version of 5G Advanced called 5.5G, which it hopes to bring to market in the second half of this year. The company claims its 5.5G will offer a tenfold improvement in network performance over standard 5G, enabling faster IoT devices, more efficient factories and transportation systems, and 3D content creation.

The vendor said it has been working with 30 operators globally to pilot some of the tech it has been developing including: extremely large antenna arrays (ELAA) which underpin 10 gigabit downlinks; flexible spectrum access to support gigabit uplinks and passive IoT which it says can enable 100 billion IoT connections.

Decoupling headwinds

A striking feature of MWC Shanghai was the lack of foreign visitors, comprising fewer than ten per cent of the 37,000 participants, according to the organisers GSMA. The mood reflects the current state of the market where Chinese companies are facing headwinds in some markets due to the escalating tensions with the US.

The European Commission last month urged European Union countries to exclude Huawei and ZTE from their 5G networks, which could lead to restrictions expanding beyond the 10 members that have already designated them as high-risk suppliers.

And while Chinese companies continue to tap into regions like Africa, the Middle East and Southeast Asia, their momentum has slowed of late, according to S&P.

AI is the latest tech sector to be impacted. The US placed more than a dozen players in the Chinese AI chip sector on a trade blacklist last year and the Biden administration is tightening these further to make it harder to sell AI chips to China without a licence.

According to Reuters, the Dutch government on Friday announced new restrictions on exports of some semiconductor equipment, boosting a US-led drive to curb supplies of high-tech components to China.

These decoupling headwinds could inevitably lead to divergent 6G standards paths, despite recent moves on the Open Gateway initiative. International standards groups are holding discussions on 5G Advanced. “At this point, we’re not hearing anything openly about excluding Chinese players” from the process, one expert told Nikkei.

But if the decoupling trend continues, “I think there could be a separation of standards” between China and the US, said Ichiro Satoh, a professor at Japan’s National Institute of Informatics.

“That would be problematic for both sides,” Satoh told Nikkei. “They have to look for common ground.”

International standards for 6G are expected to be set by around 2030, with commercial use to start soon after. Huawei reportedly aims to build a track record with 5.5G now to put it in a stronger position to influence this process.